Tax Preparation Services

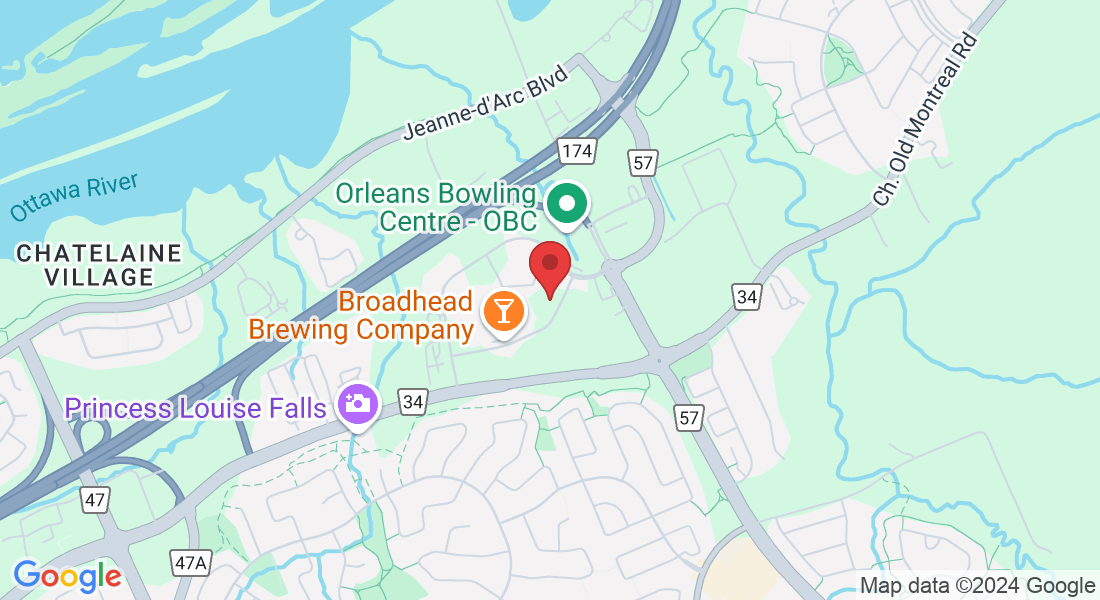

With changes to tax laws occurring frequently, it can be difficult to keep up with the latest changes. Let our tax preparation professionals take care of this for you. We are registered with the CRA (Canada Revenue Agency) as a registered tax e-filer.

Bookkeeping

Tax Preparation

Personal Tax Preparation

Preparation for anything is the key to success.

This applies to filing your individual and family taxes as well. In order to make your appointment as efficient as possible, it also means the you should bring as much information as you can, that pertains to your financial status to Centrosome Inc.

Once we have all this information, we can move forward with calculating what credits and deductions you deserve. After that we will file your tax return electronically.

Download Our Organizers >>

Below is a checklist of documents you should bring with you to our office for our meeting.

Income Receipts along with any other documentation pertaining to income

All T4 slips (Employment income)

Employment insurance benefits (T4E)

Interest, dividends, mutual funds (T3, T5)

Tuition / education receipts (T2202A)

Universal Child Care Benefit (RC62)

Old Age Security and CPP benefits (T4A-OAS, T4AP)

Other pensions and annuities (T4A)

Social assistance payments (T5007)

Workers’ compensation benefits (T5007)

Receipts

Expenses

Tool expenses (Trades persons)

Medical expenses

Transit pass receipts

Child care expenses

Adoption expenses

Moving expenses

Children’s arts and sports programs

Carrying charges and interest expenses

Office – in-home expenses

Exams for professional certification

Professional or union dues

RRSP contribution slip

Liabilities

Support for a child, spouse or common-law partner

Interest paid on student loans

Donations

Political contributions

Charitable donations

Additional documentation

Notice of Assessment/Reassessment

Canada Revenue Agency correspondence

Sale or deemed sale of stocks, bonds or real estate

Northern residents deductions

Rental income and expense records

Business, farm, or fishing income/expenses

Automobile / Travel logbook and expenses

Disability Tax Credit Certificate

Declaration of Conditions of Employment (T2200)

Volunteer Firefighters certification

Business Tax Preparation

Keeping your business in compliance!

If you are looking to have your annual T2 taxes prepared for your provincial or federally incorporated business, we would be happy to help. Please Contact Us today so that we may better understand your needs and get your business taxes taken care of.

We also prepare GST/HST remittances, payroll source deductions remittances and annual payroll summary reporting for our clients.